I entered my insurance policy information online however it states "pending"? This suggests the insurance policy details you got in did not verify with your insurance coverage firm's database instantly.

If you think the DMV has wrong details, please call NVLIVE The info on documents can be investigated to verify if you are needed to find right into the workplace. Why did I receive a qualified letter? A qualified letter is the notice of a feasible suspension - division of motor vehicles. This can suggest we did not obtain an action from the registered proprietor within the (15) days feedback time or the insurance provider did not reply to our notice within their (20) day action time.

You might not legitimately drive the lorry as of the suspension date listed in the letter. The "negligence" letter indicates your insurance business has responded to the verification card sent to you by confirming your insurance policy info.

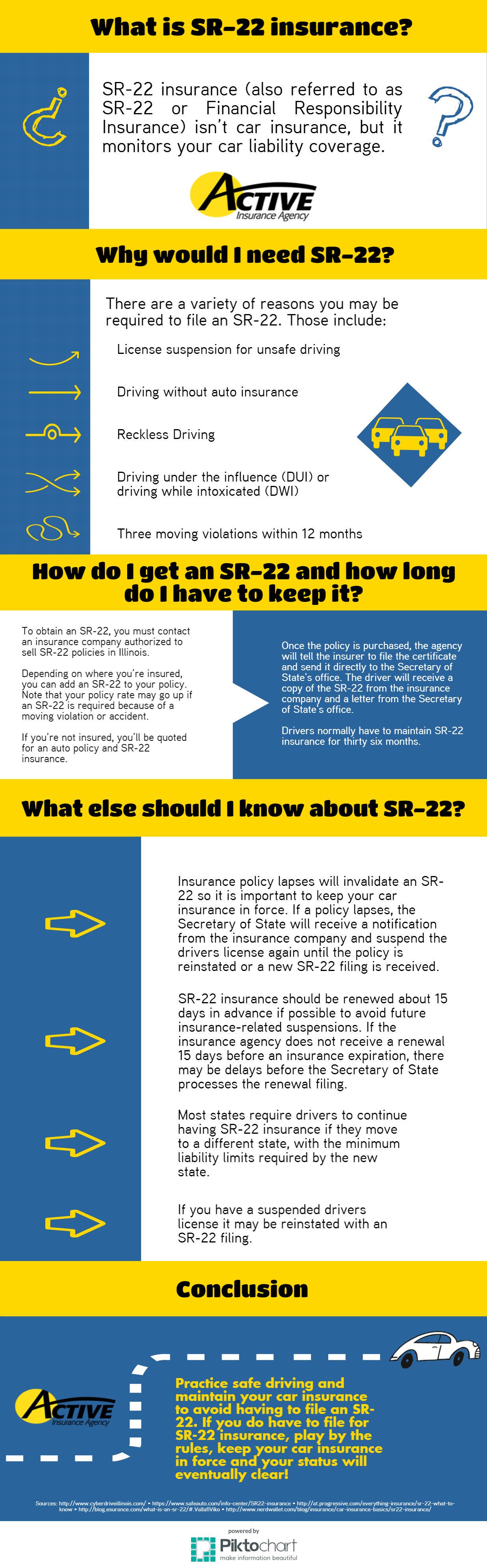

This implies your insurance policy business confirmed protection with the DMV, as well as nothing even more is needed. How does this connect to an insurance policy reinstatement? "SR-22 Insurance coverage" is a Certificate of Financial Obligation that your insurance coverage business will file with the DMV.

What Does Sr-22/sr26 Financial Responsibility Certification - Virginia ... Mean?

The penalty for the gap of insurance policy might still apply. I will certainly be car park my lorry and might get "garage" insurance policy. Garage insurance policy is NOT responsibility insurance policy, as well as for that reason is not acceptable or reported to the DMV.

If you drop the liability insurance policy for any factor, you need to cancel the enrollment and also surrender the certificate plates. NVLIVE verification uses just to obligation insurance policy (underinsured). See Certificate Plate Surrender. Please get in touch with your insurance coverage representative to verify whether you have obligation coverage. I'm having a conflict with my insurance company/agent.

In Wisconsin, You Need to Have an SR-22 for a Minimum of 3 Years There is a lot of complication surrounding both SR-22s and also OWI offenses as a whole. An SR-22 is a type that your insurer submits with the DMV to license that you are guaranteed after being classified as a high-risk driver. If your provider terminates your policy, or if they will certainly not file your SR-22, you will need to locate a new carrier. insurance. You are not enabled to submit the SR-22 with the DMV on your own. Will Insurance Policy Rates Remain High? Your insurance policy prices are most likely to stay high for concerning 5 years, depending on your company.

Claim hi to Jerry, your brand-new insurance policy agent (insure). We'll call your insurer, review your existing strategy, then discover the coverage that fits your demands and saves you cash.

How Long Does An Sr-22 Last? - Insurance Panda Things To Know Before You Get This

If you have an existing policy you might be able to include your SR-22 to your policy with your insurance provider. If your car insurance coverage had been canceled as a result of your current driving offense, after that you should show that you need the SR-22 insurance on your application. SR-22 is very similar to basic cars and truck insurance policy, however, it will certainly be far more costly.

Even if you are not a cars and truck proprietor, you will certainly be called for to submit an SR-22 for non-owner standing. In Illinois, SR-22 insurance policy is required for three continuous years - sr22.

If you move out of the state of Illinois you have the ability to waive your responsibility of submitting an SR-22 in the state of Illinois by submitting an affidavit, however, it is exceptionally likely that you will need to acquire SR-22 insurance in the new state. There are very few options to SR-22 insurance policy as the state has actually flagged you as an at-risk driver, therefore, the choices are unusual and also costly.

Alternatively, you can transfer a surety or property bond - insurance coverage. To find out more visit the Assistant of State site.

The 10-Second Trick For The Traffic Offender's Guide To Insurance - The ...

It is crucial to bear in mind that your must maintain the SR-22 insurance policy for the specified timespan or your license is put on hold once more. department of motor vehicles. If your policy cancels or lapses for any kind of reason the insurance provider is legitimately obliged to file a SR-26, which informs the state of the plan cancellation.

insurance insurance group motor vehicle safety sr22 coverage no-fault insurance

insurance insurance group motor vehicle safety sr22 coverage no-fault insurance

When your present company does not release SR22 forms it's time to do some research. When seeking to buy an SR22 there are a couple of points to consider: 1) Make sure the insurer is licensed to do company in the state of MO (insurance). 2) Like with every little thing else, experience matters.

Why do I need an SR22 if I do not have a car? Every state that requires an SR-22 filing, calls for that you have the state mandated responsibility insurance coverage whether you are a car owner or a non-owner (do not own auto).

By requiring you to have SR22 insurance coverage with or without an auto, the state feels they are securing the various other drivers when driving. Where can I obtain an SR22? As stated above, not all insurance provider offer SR22s., powered by Wessell Insurance coverage Services, llc, has actually been giving vehicle insurance policy considering that 2006 (driver's license).

The Ultimate Guide To Browse around this site Vehicle Insurance Requirements - Utah Dmv

An SR22 is a form released by an insurance policy business that educates a state that you have the minimum insurance coverage called for in that state after obtaining your driving privileges back. It is not insurance or protection, however a means your state ensures your vehicle insurance policy is energetic. Secret Takeaways An SR22 is a type your vehicle insurance policy business sends to the state so you can abide by court- or state-ordered requirements.

credit score driver's license sr-22 deductibles sr22

credit score driver's license sr-22 deductibles sr22

SR22s can be submitted with both typical insurance protection plans and non-owner insurance coverage. This document shows that you have actually satisfied your economic obligation for having the minimum responsibility insurance coverage.

You contact your insurance policy provider, as well as they should provide you the type once you have actually purchased the minimum quantity of car insurance policy - driver's license. You'll need to keep the minimum amount of insurance coverage and see to it you have a current SR22 kind through established by the state you reside in.

The SR22 can set you back about $25 in filing costs. Your insurance coverage premium will enhance as an outcome of the offense. As a whole, a DUI-related SR22 might lead to an increase in insurance coverage expenses by between 20% and 30% - ignition interlock. But an SR22 issued for uninsured driving is around $30 and also can rely on your credit.

How A Dui Affects Your Auto Insurance (Sr-22 Requirements) Things To Know Before You Get This

If you do not possess a car however have to submit an SR22 due to a conviction, you'll require to ask your agent about a non-owner policy (no-fault insurance). These plans cover your driving when you drive someone else's lorry or a rental and price much less than insuring a cars and truck. If you switch over insurer while you have an SR22, you'll require to file for a brand-new SR22 before the first plan runs out.

auto insurance ignition interlock driver's license insurance coverage sr-22 insurance

auto insurance ignition interlock driver's license insurance coverage sr-22 insurance

This kind tells the state about the change. insurance group. Obtaining the filing removed may lower your rates on your insurance coverage. Just how Do I Figure out if I Still Required SR22 Insurance? You'll require to speak to the firm that issued the initial demand to establish if the declaring is still essential. The company will be either the state DMV or the court system.

In some states, if you cancel your SR22 declaring early, you may be needed to restart the period over once more, also if you were just a couple of days from the day it was set to run out (insure).

sr-22 insure insurance sr-22 dui

sr-22 insure insurance sr-22 dui

What is an SR-22? An SR-22 is a certificate of financial responsibility needed for some drivers by their state or court order. An SR-22 is not a real "kind" of insurance coverage, but a kind submitted with your state. This kind works as proof your auto insurance plan satisfies the minimal liability protection required by state law.

The 4-Minute Rule for What Is An Sr-22 And When Is It Required? - Nationwide

Do I need an SR-22/ FR-44? Not every person requires an SR-22/ FR-44. Laws vary from one state to another. Generally, it is called for by the court or mandated by the state just for specific driving-related infractions. : DUI convictions Reckless driving Mishaps triggered by without insurance vehicle drivers If you need an SR-22/ FR-44, the courts or your state Electric motor Car Division will certainly alert you.

Is there a fee associated with an SR-22/ FR-44? This is an one-time fee you need to pay when we file the SR-22/ FR-44. insurance group.

A declaring fee is charged for every individual SR-22/ FR-44 we submit. For instance, if your partner gets on your policy and also both of you need an SR-22/ FR-44, after that the filing cost will certainly be charged twice. Please note: The cost is not consisted of in the rate quote since the filing cost can differ (sr22).

For how long is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 must stand as long as your insurance coverage plan is energetic. If your insurance policy is terminated while you're still required to lug an SR-22/ FR-44, we are required to alert the correct state authorities. If you don't maintain constant protection you might shed your driving advantages.

Some Ideas on Illinois Sr-22 Insurance You Need To Know

A Tennessee SR22 can be needed for a total amount of 5 years from your day of suspension. If the Tennessee SR22 is submitted for a total of 3 years (36 months) within the 5-year period, the SR-22 may be cancelled supplied it is not required on any kind of other suspension. If 5 years pass from the day of suspension before you restore your benefits, after that the Tennessee SR22 would not be needed.

The SR-22 demand starts on the date of the sentence. The SR-22 requirement begins on the end day of the suspension. sr-22 insurance.

The SR-22 requirement starts when you use for the license and ends when the permit runs out. Out of State Filing, Even if you live out of state, you must submit an SR 22 with Oregon (if called for) before an additional state can provide you a chauffeur license.

Any kind of Colorado homeowner that has actually had their vehicle driver's license revoked for driving drunk is required by the Division of Profits, Department of Motor Vehicles (DMV) to obtain "Evidence of Insurance policy" prior to reinstatement of their driving advantages. This type of insurance coverage, referred to as an SR-22, calls for the insurance coverage service provider to report any type of lapse in insurance protection to the Colorado Car Division.